Premium Bonds

For instance a bond with a face value par value of 750 trading at 780 will reflect that the bond is trading at a premium of 30 780-750. Web A premium bond is a bond trading above its face value or costs more than the face amount on the bond.

Premium Bonds Your Old Bonds Could Still Win The Jackpot Check Prize Draw Now Personal Finance Finance Express Co Uk

Web Premium Bonds are valued at 1 each and the minimum holding is 25 maximum 50000.

. Since they do not expire you can still cash in old paper Premium Bonds if theyve been selected. Paying a premium for a bond may not seem like a good financial decision on its face but there are times when premium bonds can. The principle behind Premium Bonds is that rather than the stake being gambled as in a usual lottery it is the interest on the bonds that is distributed by a lottery.

Web Introduction of Premium Bonds. The bonds are entered in a monthly prize draw and the government promises to buy them back on request for. Web The home of Premium Bonds.

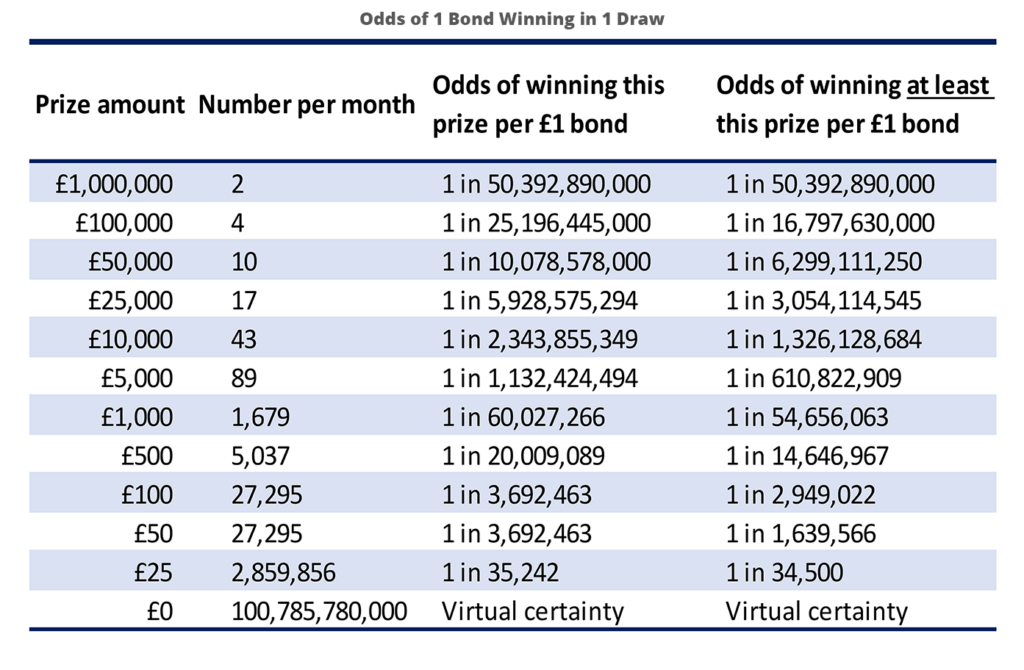

This occurs when a bonds coupon rate surpasses its prevailing market rate of interest. A bond might be valued and traded at a premium because of the returns it gives to its investors ie the interest rate offered by the bond will be higher than the market rate and other bonds. Odds of winning for each 1 Bond number.

Open an account and you could win big in our monthly prize draw. Web A Premium Bond is a lottery bond issued by the United Kingdom government since 1956. In addition to this ERNIE picks two 1 million jackpot winners.

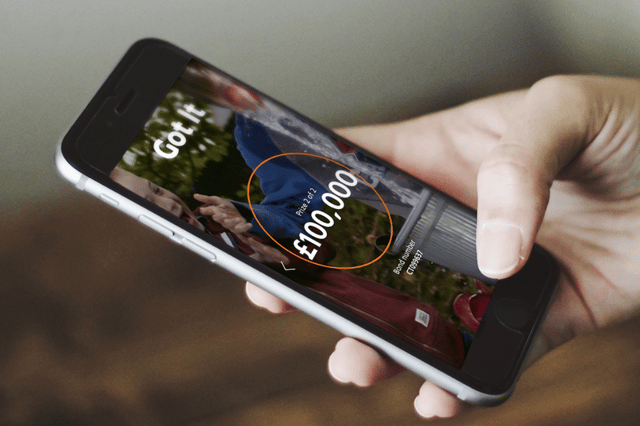

Web NSI Premium Bonds Account number. Every month the Premium Bonds are put into a monthly drawing to win tax-free prize money from 25 to 1 million. Web Premium Bonds are a type of savings investment offered in the UK by National Savings and Investment NSI.

A premium bond is a bond that is valued higher than its face value ie at a premium. Web A premium bond is a bond that is selling for more than its par value on the open market. We created Premium Bonds and you can only get them from us.

You must be aged 16 or over and buying Bonds for yourself or for a child under 16. At present it is issued by the governments National Savings and Investments agency. You or the child must already have some Premium Bonds and you must know your or the childs holders number.

Prizes are drawn monthly and range from 25 to 1 million paid free of tax. Bonds usually trade for a premium if their interest rate is higher than the market average. Each investment must be at least 25 and in whole pounds.

The amount that your clients can invest is 50000 giving investors more chances to win tax-free prizes. A bond might trade at a premium because its interest rate is higher than the current market. Web A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value.

All You Need To Know About Government Prize Bonds Profit By Pakistan Today

Ernie To Cut Back Mature Times

Premium Bonds Operator Ns I Must Work Hard To Win Back Customers Bbc News

Eine Auswahl An Premium Bonds Zertifikaten Und Gluckwunsch Brief Stockfotografie Alamy

Premium Bonds A Better Bet For Savers When Interest Rates Are Low Moneyweek

Premium Bonds Will They Make You Rich Eat Sleep Money

The Winners In London For September S Premium Bonds Draw Londonworld

Premium Bonds Are They Worth It

Is It Time To Ditch Premium Bonds Be Clever With Your Cash

Premium Bonds How To Buy And Sell Premium Bonds

How Much Do You Really Win On Premium Bonds See My Wins

How Much Do You Really Win On Premium Bonds See My Wins

Ns I Premium Bonds Winners February 2020 How Many Bonds Do You Need To Win A Million Which News

Should You Buy Premium Bonds Moneyunshackled Com

Ns I If You Still Receive Your Premium Bonds Prizes In The Post You Re Missing Out On Receiving Your Prize Money The Quickest Way Switch To Having Your Prizes Paid Straight To

Ns I Seeks Adviser To Help Premium Bond Winners Ftadviser Com

What Are Premium Bonds And How To Save With Them